b&o tax states

Use this chart to find the amount of tax due and the total of the order. No deduction is allowed for labor materials taxes or other costs of doing business.

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

Most classifications come with a tax rate below 1 percent which is low.

. Email notifications from the Piscataway Tax Office. Some cities impose a BO tax that is not collected by the state of Washington. Manufacturing Wheat into Flour.

The BO offers very few deductions and those allowable are often within narrowly defined industry sectors. The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington. If you run a 1000000 manufacturing or wholesaling firm you will owe 484 or 4840 in business and occupation taxes.

In addition this department collects annual sewer fees. What Is The Washington State BO Tax. An average of 484 percent 00.

Businesses receive a classification with a corresponding tax rate. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. So that means you only get to deduct returns never collected money and out of state sales.

B O tax rates. You pretty much pay BO on all your net in-state revenue. Get the sales tax schedules of 6625 rounded to two decimal places from 1 to 100.

This means you pay taxes on the total amount of revenue you pull in for your business whether you make a profit or not. It applies to the gross income of the business. Business and Occupation Tax.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. Average state tax burden. Sales Tax States do its best to make the most accurate geolocation for every zip code.

However your business may qualify for certain exemptions deductions or credits. It is the Manufacturing BO tax rate of 0 that makes the manufacturing industry tax-free. South Carolina charges all three major state tax types but does so in moderation.

Senate Bill 5980 would eliminate the business and. Washington unlike many other states does not have an income tax. Heres how the state BO works.

However you may be entitled to the. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. Slaughtering Breaking and Processing Perishable Meat.

While there is an exemption for the sale or rental of real estate a license to use real property is taxable under service BO. Soybean Canola Processing. Manufacturers and suppliers of manufactured and by-products pay tax based on the value of their products.

The BO tax is imposed on every person engaging in any business activity in the state. Most Washington businesses fall under the 15 gross receipts tax rate. You can find a list of cities that self-collect their Business and Occupation tax by clicking here.

New Law Imposes BO Tax Surcharges on Various Services and an Added 12 BO Tax on Certain Banks Washington. Are There Deductions for BO Tax. It is measured on the value of products gross proceeds of sale or gross income of the business.

Heres what the BO tax looks like for your business. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. BO also does not consider income or loss offers no deduction for cost of.

The state BO tax is a gross receipts tax. The BO tax for labor materials taxes or other costs of doing business. A distinguishing factor of license to use is the right to use the real property owned by another party does not confer exclusive.

This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. A check for 5004 2007 will be drawn from your bank account. When paying the B O tax to the Department of Revenue you declare your income in different categories.

Extracting Timber Extracting for Hire Timber003424. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. Sales and excise taxes.

For example if you extract or manufacture goods for your own use you owe BO tax. Accounts will be updated within two 2 business days of receipt of payment submission. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax.

The appropriate BO tax classification depends on the nature of the business activity. They then apply that rate to their gross receipts and cut Washington a check. 15 hours agoProposal would eliminate BO tax for small businesses.

Its sales and excise tax burden of 262 clocks in. Subsequently the Division issued some answers to frequently asked questions FAQs regarding employer withholding tax and personal income tax in New Jersey. Washingtons BO tax is calculated on the gross income from activities.

For state personal income tax purposes the Division states New Jersey sourcing rules dictate that income is sourced based on where the service or employment is performed based on a. Washington small business owners would get a tax break under a state Senate proposal. Please refer to the New Jersey website for more sales taxes information.

TaxValet will not automatically handle local and city gross receipts taxes on your behalf unless specifically requested and agreed upon. The tax amount is based on the value of the manufactured products or by-products. Washington State BO tax is based on the gross income from business activities.

Extracting Extracting for Hire00484.

Excise Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

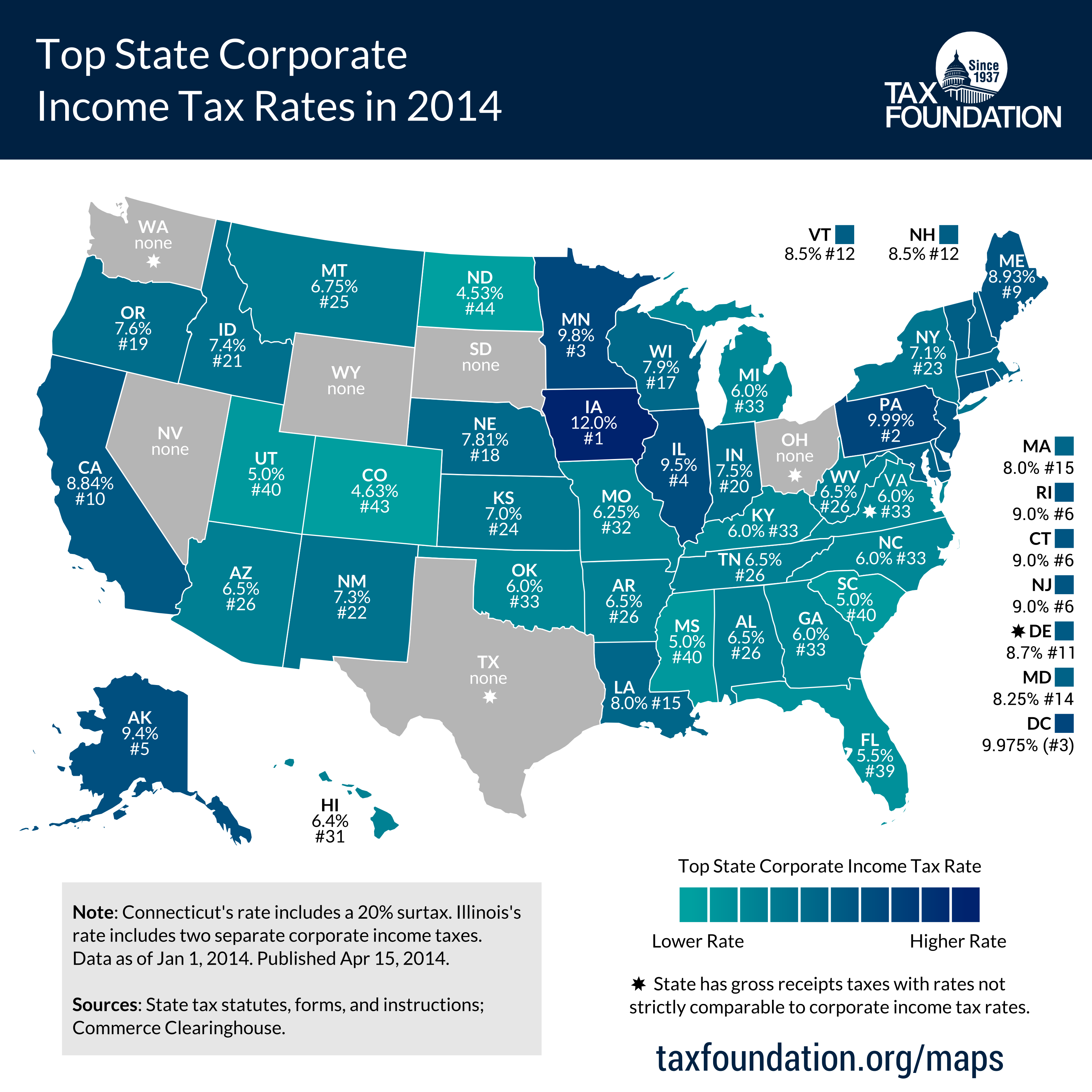

Top State Corporate Income Tax Rates In 2014 Tax Foundation

What Is Gross Receipts Tax Overview States With Grt More

Tax Filing Example Washington Department Of Revenue